- Get in touch with a lawyer which have a property sense who’ll render advice and you will assistance to drafting and examining promote characters, sales deals and other records.

- Get preapproved for a home loan. Full-day a residential property investors have a tendency to spend installment loans Kansas dollars to own foreclosed homes, making the foreclosure field really aggressive. Cash customers has actually a bonus, and if you are in a position to fool around with dollars, that is higher. Resource a foreclosures buy is additionally practical, but when you propose to go that station, your purchase render includes research to pay in short order. It is essential, ergo, that you work on a lender locate prequalified having an effective loan and then have your financial spell out exactly how much you happen to be in a position to spend.

- Look around. Below are a few homes much like the one you desire to get. Characteristics offered at foreclosures deals usually have not already been reported to have profit ahead of time, therefore all you might have to embark on at the time from get would-be an explanation, floors package and a few photographs. Its helpful to rating a concept of what your budget is always to feel delivering your. Whenever you can inspect the brand new properties you’re considering (sometimes it is possible to that have REO homes), try to guess the cost of fixes otherwise advancements which could be needed.

- Create your give. Make a quote from the a market or run the broker to help you negotiate a buy straight from the financial institution you to keeps the term. Note that you’ll need big bucks put otherwise cashier’s have a look at so you’re able to contain the pick. Keep in mind that a property foreclosure product sales get run out of a number of the terminology popular from inside the fundamental domestic-sales contracts, such contingencies getting voiding brand new business if the property goes wrong a check. Pastime their give letter accordingly (so many conditions brings rejection, even when the pricing is best) and make certain so you can basis potential fix will cost you to your give speed.

- Romantic the offer. When your promote is acknowledged, agenda an evaluation, work at your own positives towards the people last negotiations and place an excellent closure date.

Tips getting Foreclosed Homes

- Lender other sites. Of numerous lender websites promote directories away from foreclosed features on the market.

- The fresh U.S. Service from Houses and you will Urban Creativity (HUD) provides listings out of virginia homes by the bodies providers, as well as foreclosure and attributes if you don’t caught legally enforcement businesses.

- Foreclosure postings at on the internet a residential property number properties such as for example Zillow and you can RealtyTrac.

- The new mls (MLS), generally speaking readily available only to subscribed real estate agents, listings foreclosed features as well as typical home sales. Your own representative otherwise large financial company makes it possible to tap which funding to own features close by.

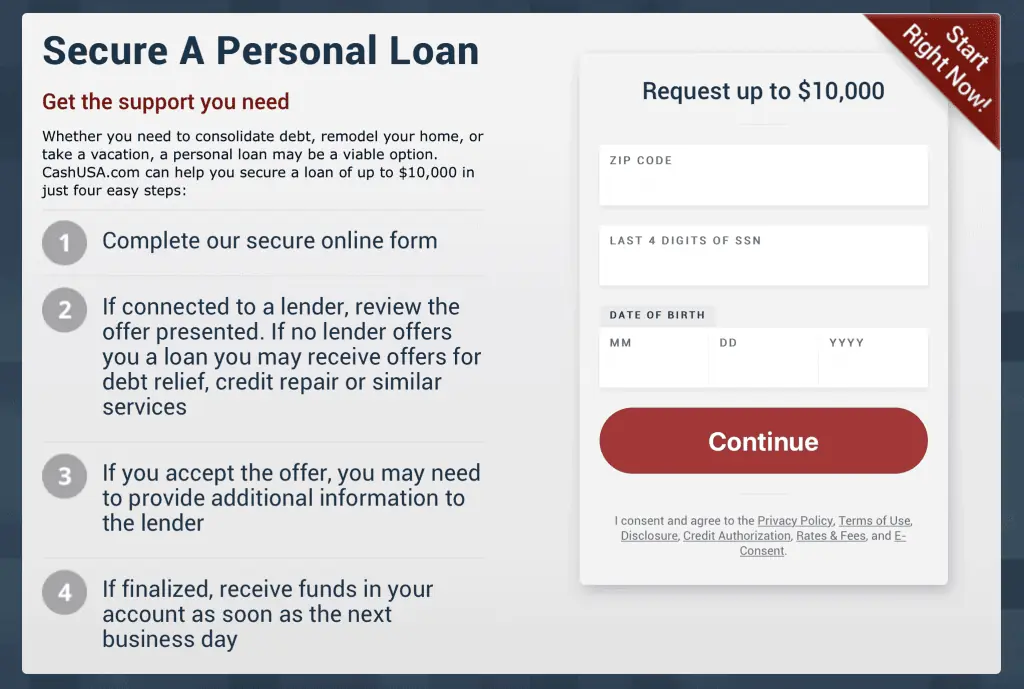

If you plan to finance your own property foreclosure purchase, you’ll need to qualify for home financing exactly as if you was indeed to find out-of a citizen.

Your own credit scores will likely donate to an effective lender’s decision to help you material you that loan that will basis to the the pace and fees they’ll charge a fee. Regardless if you are funding a foreclosures otherwise a far more antique house buy, highest credit scores fundamentally bring about greatest borrowing terminology.

As with any mortgage, the lender will most likely like to see research as possible pay the monthly home loan repayments, and they’ll probably focus on a credit check also

Before you apply to have foreclosure investment, it certainly is a smart idea to review your credit score and you may look at your credit scores understand what your location is. When you can waiting along with your credit rating provides area to own improvement, manage raising your credit rating having per year roughly before applying for a financial loan.

Foreclosed homes would be an excellent launching mat for real property money, if you don’t a route to a more affordable house to you personally as well as your family unit members.