Courtesy , Experian, TransUnion and Equifax will give all You.S. customers 100 % free each week credit history thanks to AnnualCreditReport to help you manage debt fitness inside the sudden and you can unmatched adversity as a result of COVID-19.

On this page:

- Is 650 a good credit score?

- Average Financial Rate of interest With a beneficial 650 Credit history

- What Additional factors Affect Your own Financial Costs?

- Be prepared and you may Know Your Borrowing from the bank Before you apply

- Just how to Change your Credit history Before applying for a home loan

A credit score regarding 650 departs significant place having improvement-it’s considered to be a good «fair» score by credit scoring model FICO . An effective FICO Rating ? from 650 matches certain lenders’ minimal criteria to possess a mortgage loan-however, fico scores aren’t all of the mortgage brokers look for whenever determining simply how much to help you give your or just what rates they’re going to charges.

Was 650 good credit?

Into the FICO Get measure directory of three hundred so you’re able to 850, highest scores indicate better creditworthiness, or healthier likelihood of repaying financing. A great FICO rating from 650 is known as reasonable-a lot better than terrible, but below a great. It falls underneath the national mediocre FICO Score away from 710, and you may firmly in the reasonable get directory of 580 to 669. (A rating off 650 utilizing the VantageScore rating program in addition to falls in its reasonable range of 601 in order to 660; FICO Ratings be commonly used in the mortgage community, so our company is focusing on a beneficial 650 FICO Score.)

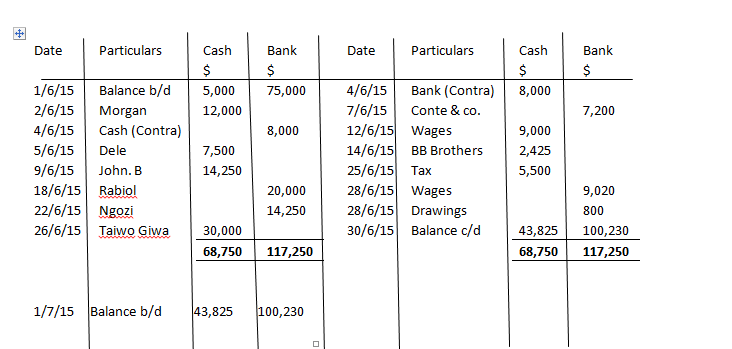

Mediocre Home loan Interest Which have an effective 650 Credit history

Mortgage lenders, like other creditors, typically designate rates based on how high-risk they think it should be to make you financing. Borrowers thought to be greater borrowing from the bank dangers-men and women deemed less likely to pay off their financing-is recharged large costs than simply down-risk consumers.

Good 650 credit score, like most most other FICO Get in the reasonable variety, will ban you against delivering a home loan lender’s greatest-readily available interest rate. Specific lenders may thought good 650 FICO Rating grounds for denying a mortgage application completely, but an excellent 650 get suits of numerous lenders’ lowest lending conditions. Additionally it is sufficient to qualify for U.S. government-backed mortgages awarded from the Federal Homes Administration (FHA), Institution regarding Veteran’s Facts (VA), together with You.S. Service from Farming (USDA).

Predicated on FICO is the reason Loan Savings Calculator, the newest federal average interest to the a thirty-season repaired $250,000 home loan to possess candidates that have FICO Score ranging from 640 to 659 payday loans Cullman are step 3.598%. To possess assessment, a somewhat most readily useful FICO Rating regarding 660 to 679 mortgage qualifies to have a lower rate of step three.168%, and therefore means a discount of more than $several,100000 across the lifetime of the borrowed funds. (An applicant having an excellent FICO Rating from the 760 so you can 850 assortment, by contrast, create qualify for a 2.555% price, and you may a benefit of greater than $fifty,100000 along the lifetime of the mortgage.)

Borrowers with FICO Scores of 650 are likely to be considering varying-rate mortgage (ARM) financing, that have introductory rates of interest one get a-flat quantity of years-normally you to definitely, however, either around three, four, 7 if not 10-immediately after which change annually. Arms is problematic to handle, because their rates and you will monthly payment numbers can increase notably per year pursuing the basic months concludes.

As the loan providers determine its lending guidelines separately, it may be it is possible to to locate a lender that issue you a predetermined-price home loan which have a reliable rate over the longevity of the new mortgage. If for example the FICO Rating try 650, one interest may be relatively steep, however the money are far more foreseeable than simply which have a supply loan.